8 Reasons Why Real Estate Tokenization Benefits Property Owners

Landshare Team

What comes to your mind when considering whether there will be an increasingly high demand for real estate properties with time? The answer should be affirmative since we know that land is a finite resource, and so are properties. This more was needed to drive the demand for real estate properties, at least not for another century. However, property owners do not need to worry since real estate tokenization solves this issue.

One of the most effective use cases of blockchain technology—tokenization—has shown impressive results and assured a bright future. Real estate tokenization was among the first implementations of the technology, and it was indeed successful. McKinsey, a global management consulting firm, estimates that the volume of tokenized digital securities will hit $5 trillion by 2030, while other reports suggest that real estate tokenization will have a significant share in it.

A Boston Consulting Group (BCG) report showed that the market size of the tokenized real estate sector in 2022 was $2.7 Billion. However, it is expected to reach $16 trillion by 2030. Such huge numbers are only possible with supply meeting demand. Tokenization brings enormous possibilities, and property owners can now be assured of potential increased demand for tokenized real estate properties.

We must investigate the reasons that are expected to increase the demand for tokenized real estate. Let’s do this by first understanding what tokenization means.

What Is Real Estate Tokenization?

Tokenization is the digital representation of assets on blockchain networks. Real estate tokenization does the same by representing property value through blockchain-based tokens. After tokenization, the real estate sector experienced remarkable changes, as it eliminated inherent flaws and brought some unique features.

Real Estate Tokenization Pushes Demands in Market

The benefits, including rational ownership, increased liquidity, transparency, and security, place tokenized real estate ahead of the traditional market. Investors and property buyers are drawn towards tokenized real estate due to these offerings and likely to increase the demand in the contingency.

The demand for real estate investment has continued to grow. According to KPMG, the global commercial real estate investment hit $830 billion in 2019, demonstrating growing interest. On the other hand, average investors have been massively included in the real estate market because of some practical ways to invest, such as Real Estate Investment Trusts (REITs). The S&P Global REIT Index has seen notable growth in the past few years, indicating the rising demand for real estate investment.

Tokenization offers a more democratized way of investing in real estate, ensuring a huge future demand. Let’s delve into the offerings of tokenized real estate to understand why it could drive more demand:

Accessibility to Small Investors

Fragmentation or fractional ownership of real estate properties through tokenization not only makes it possible for small investors to participate but also empowers them. By making tokenization accessible to small investors, tokenization opens up a vast pool of untapped interested buyers. Once this crowd enters the space, the real estate market could see unprecedented demand, giving small investors a significant role to play.

Tokenization is often hailed as the 'democratization of the real estate sector '. This term refers to the idea that tokenization can make real estate investments more accessible to a wider range of investors, not just the ultra-wealthy. Many reports show that ultra-high-net-worth individuals (UHNWI), a term used to describe individuals with a net worth of over $ 30 million, prefer real estate investments for stability, cash flow, appreciation, and diversification. According to Tiger 21, a network of UHNWI entrepreneurs and investors, about 27% of these HNIs' investment portfolios consist of real estate investments.

If given opportunities, small investors are likely to follow the HNI investment strategy to benefit from the stability, cash flow, and appreciation of the real estate sector. Tokenized real estate provides many investors with an opportunity to enter the market.

Minimum Required Investment

Traditional real estate markets have always had a barrier to entry, given the requirement of high capital to invest. This has restricted small investors from entering the market, but tokenization solves this. Tokenized real estate properties are divided into small units and become affordable even for retail investors.

The low threshold for entering the real estate investment market has allowed many investors to enter, which was never possible earlier. There are numerous active projects in the tokenized real estate market that facilitate real estate investment with as low as $50. In comparison to traditional real estate, which might require from $100K to $1 Million, depending on the property, there are enormous possibilities in the tokenized real estate market.

Global Reach Brings Investment Options

Tokenization doesn't just allow investors to invest in real estate in any corner of the world, it opens up a world of possibilities. This global reach liberates investors from the limitation of investing in regional properties, offering them the excitement of exploring international properties with the possibility of a better return on investment and rental income yield.

Several studies show that nearly 90% of all US-registered real estate properties are accessible only to accredited investors. This shows that many investment options are only available to a small number of investors.

For instance, if you are an aspiring real estate investor from Indonesia, you can invest in tokenized real estate based in the United States. This access to international real estate properties was unimaginable until tokenization.

High Liquidity

In tokenization, real estate properties are turned into tokens that investors or property buyers can hold. These tokens can then be easily traded to other investors. This easy and quick selling and buying of tokens not only makes the tokenized real estate sector highly liquid but also provides property owners with a sense of security, knowing that they can receive cash in exchange for their property or part of it quicker than they could traditionally.

Property owners can receive cash in exchange for their property or part of it quicker than they could traditionally. Investors or buyers are also not burdened with carrying the investment for long periods.

Easy Property Management

Blockchain technology plays a significant role in the easy management of real estate properties with the help of smart contracts. Tokenized real estate properties do not need intermediaries to carry out the transactions. Self-executable smart contracts take care of the property transactions once the conditions are met.

Transparency

With blockchain technology comes the assurance of security and transparency. As smart contracts take care of the process, participants can see the whole transaction by themselves and see if everything is going according to plan. Due to the immutable nature of blockchain networks, it becomes nearly impossible to alter the transactions.

Transaction Cost

Since buying and selling tokenized real estate property is digital, it does not require paperwork, bureaucracy, or other requirements that increase transaction costs. The automated process keeps the cost minimal, making the transaction affordable.

KPMG study finds that a significant amount of time and money goes into a real estate transaction. Such transactions could sometimes take six months to 2 years and 1% to 3% of the assets’ value in fees, depending on the property. Tokenized asset transfers get done quickly and at a much cheaper rate.

Secondary Market Trading

Traditionally, real estate markets are illiquid, and it might take months to sell or resell your property. In tokenized real estate, however, since investors purchase the tokens, they can easily sell these tokens further to other investors or in the secondary market.

The real estate market has this limitation, but asset-backed tokens are easily tradable, further enhancing liquidity.

Landshare Extends Hands to Property Owners

Landshare offers the ultimate real estate tokenization services that ensures investors as well as property owners get most benefits. We ensure all the features and offerings mentioned above available on the platform. Providing access to retail investors, accessibility to international real estate, high liquidity, transparent process, low transaction cost and secondary market trading, Landshare is committed to cater both ends in the real estate market: investors and property owners.

In the End

We have explored that tokenization of real estate is more than just a fleeting trend; it is a transformative innovation reshaping the market. With enhanced accessibility for retail investors to global reach and high liquidity, tokenization is smashing long-standing barriers.

The integration of blockchain technology makes the process transparent, secure, and efficient by reducing transaction costs and simplifying property management using smart contracts. Indeed, the future is digital, and the real estate sector is still catching up with the trend. Property owners can leverage tokenization and look forward to an emerging market that is more inclusive, efficient, and dynamic.

About Landshare

Landshare is a U.S.-based platform dedicated to the tokenization of real estate properties. It enables investors to acquire fractional shares in residential properties using blockchain technology, streamlining the investment process and broadening the scope of who can invest in real estate. By integrating blockchain technology into the real estate market, Landshare offers tokenized property assets on its platform, making it possible for investments to start at just $50, thus democratizing the entry into property investment.

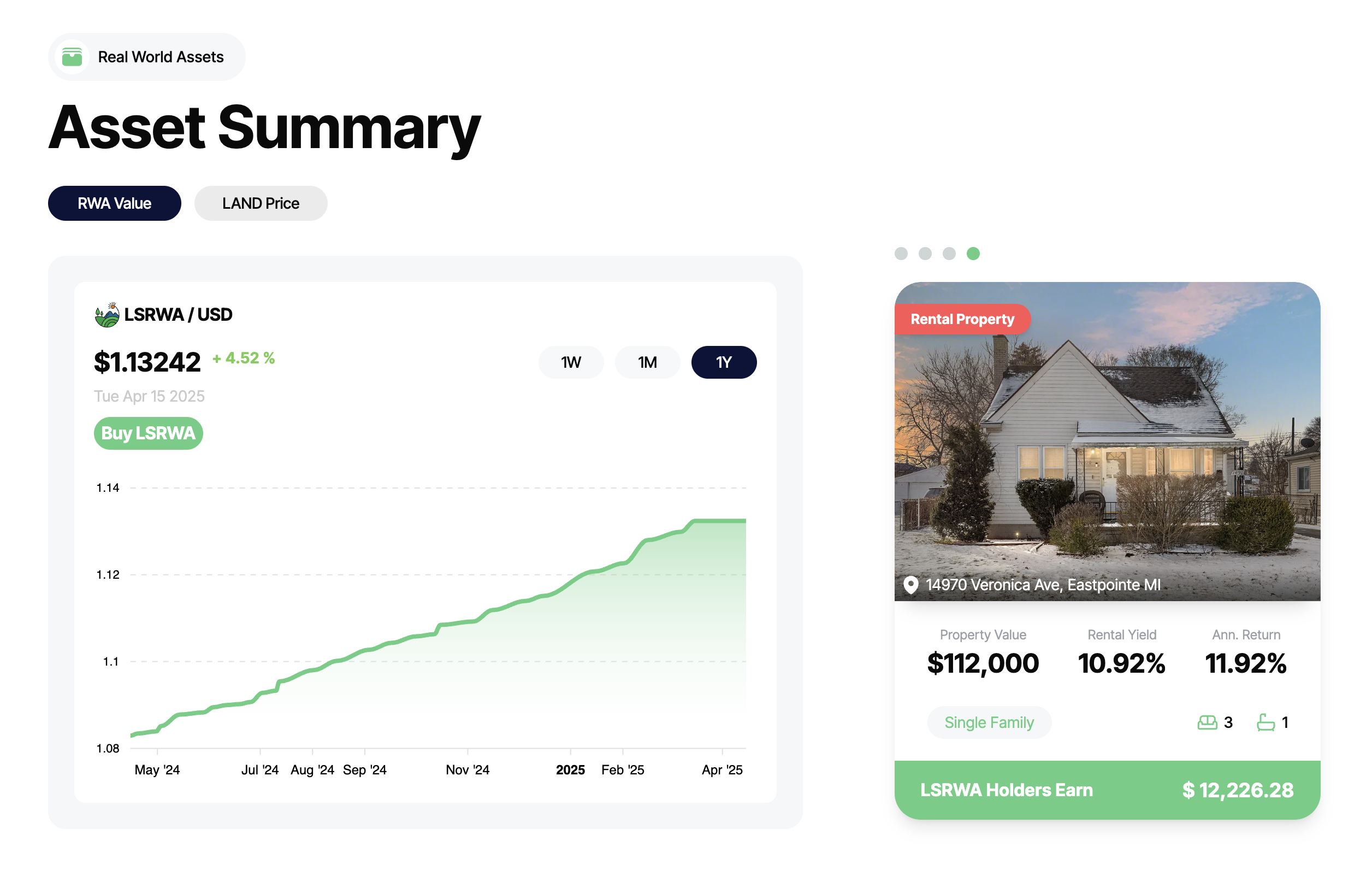

The platform employs Real World Asset (LSRWA) tokens, granting investors partial ownership in tangible property assets and marking a notable innovation in real estate investment. Landshare's utility token, LAND, has demonstrated its transactional effectiveness by successfully selling four tokenized properties on the Binance Smart Chain (BSC), affirming its readiness for the market. Addressing the traditional inefficiencies and liquidity issues in real estate, Landshare positions itself as a critical player, offering promising prospects for growth and passive income generation.

Real Estate Tokens as an Inflation Hedge? Investigating the 2025 Scenario

Landshare Team

In 2025, inflation continues to challenge the global economy. With rising consumer prices, devalued currencies, and economic uncertainty, investors are searching for dependable assets that protect purchasing power and deliver stable returns.

Traditionally, real estate has been a proven hedge against inflation — offering both price appreciation and passive income. But today, a new, more accessible alternative has emerged: tokenized real estate.

Thanks to platforms like Landshare, investors can now gain exposure to high-quality U.S.-based property assets through blockchain — combining the security of real estate with the power and flexibility of decentralized finance. The result is a next-generation inflation hedge that’s liquid, transparent, and built for yield.

Why Real Estate Works Against Inflation

Historically, real estate performs well during inflationary cycles. As the cost of goods rises, so do property values and rents. This leads to:

- Capital appreciation in physical assets

- Rising rental income that keeps up with inflation

- Consistent cash flow from tenant payments

However, traditional real estate has high entry barriers, low liquidity, and slow transaction processes. Landshare solves all of this with a blockchain-native approach.

Introducing LSRWA: A Tokenized Real Estate Solution for 2025

At the core of Landshare’s ecosystem is LSRWA, a token that represents a share of a pool of real-world, U.S.-based real estate assets. When you hold LSRWA, you're not just speculating — you're actually investing in physical properties that produce income and grow in value over time.

📈 Built-in Appreciation

The value of each LSRWA token grows proportionally with:

- Cash flow generated by rental income

- Underlying property appreciation

This means that simply holding the token over time allows investors to benefit from both rising property values and consistent income streams — two critical components of any inflation hedge.

Triple-Yield DeFi Opportunities with Landshare

What sets Landshare apart isn’t just its real estate exposure — it’s the powerful DeFi integrations that supercharge your returns.

💧 LSRWA-USDT Liquidity Pool (12% APR)

By providing liquidity in the LSRWA-USDT pool, investors can earn an additional 12% APR in staking rewards, on top of their property-backed gains. This creates a blended yield opportunity rarely seen in traditional finance or real estate.

🔁 Borrowing Against LP Tokens

Landshare is rolling out a new borrowing strategy that allows users to:

- Stake their LSRWA-USDT LP tokens

- Borrow $USDC against them

- Continue earning LP rewards and LSRWA appreciation

.png)

This innovative approach creates three income streams at once:

- LSRWA token growth

- LP staking rewards

- Potential gains from utilizing borrowed USDC

It’s a fully optimized, capital-efficient strategy for high-yield real estate exposure — and a major advantage in inflationary conditions.

🎮 Boost Returns with the Landshare NFT Ecosystem

For those seeking an even more engaging experience, Landshare’s NFT Ecosystem adds a unique gamified layer to real estate investing.

LSRWA holders can participate in this NFT-based yield enhancement system, unlocking exclusive boosts and rewards. This ecosystem allows users to:

.png)

- Earn higher yields through NFT upgrades and bonuses

- Engage in strategy-driven gameplay that complements real investing

- Turn real estate into an interactive DeFi experience

Learn more about how it works here.

Real Estate Tokens vs. Traditional Inflation Hedges

Compared to conventional options like gold or T-bills, tokenized real estate offers a compelling advantage:

.png)

Landshare’s model brings together the stability of real estate, the liquidity of crypto, and the rewards of DeFi, making it one of the most attractive options for inflation-resistant investing in 2025.

Final Thoughts: A Smarter Hedge for a New Era

As inflation continues to challenge global financial systems, LSRWA tokens offer a modern, effective way to preserve and grow wealth.

With built-in exposure to real U.S. real estate, passive income through rental yields, and DeFi-powered strategies that unlock multiple layers of returns, Landshare stands at the forefront of the tokenized real estate revolution.

Whether you're looking to safeguard your capital, generate yield, or explore new frontiers in on-chain investing, LSRWA offers a powerful, inflation-hedged solution for 2025 and beyond.

Start earning from real estate — the DeFi way. Learn more at Landshare.io

Beyond REITs: How Tokenized Real Estate is Changing U.S. Property Investment in 2025

Landshare Team

In 2025, the landscape of property investment in the U.S. is being reshaped—not just by shifting market trends, but by a powerful technological revolution: tokenized real estate.

While Real Estate Investment Trusts (REITs) have long served as a gateway for fractional property ownership, a new wave of blockchain property investment platforms is offering something REITs never could—global access, 24/7 liquidity, and full transparency. This is the age of tokenisation, and platforms like Landshare are leading the way.

💡 What Are REITs and Why Have They Been Popular?

REITs have traditionally allowed investors to gain exposure to real estate without directly owning physical property. They're regulated investment vehicles that pool money to purchase or manage income-producing real estate.

Benefits of REITs:

- Steady dividend income

- Exposure to property markets without physical management

- Liquidity (especially with public REITs)

However, REITs come with limitations:

- Lack of transparency

- High management fees

- Restricted market hours

- Limited global access

🔄 REIT vs Tokenisation: Why 2025 Is a Turning Point

Enter tokenized real estate—a model that leverages blockchain technology to digitally represent ownership in real-world properties through tokens. Unlike REITs, where investors buy into a fund, tokenization allows direct, transparent, and programmable ownership in individual assets.

Key Advantages Over REITs:

✅ 24/7 Liquidity – Trade property tokens any time on decentralized exchanges

✅ Fractional Ownership – Invest with as little as $1

✅ Smart Contract Automation – Dividends, ownership transfers, and reporting managed on-chain

✅ Global Participation – Anyone with an internet connection can invest in U.S. real estate

🌍 Globalizing U.S. Property Investment

One of the most significant advantages of tokenized real estate in 2025 is the global democratization of U.S. real estate markets. With regulatory frameworks maturing and platforms like Landshare providing fully-compliant solutions, international investors are able to access U.S. property markets without intermediaries.

This opens the door for:

- Global investors in emerging markets

- Digital nomads and crypto holders

- Institutions seeking stable, asset-backed returns

💼 Landshare: A Leader in Tokenized Real Estate

At the forefront of this transformation is Landshare—a blockchain platform that offers tokenized access to real, income-producing U.S. properties. Unlike traditional REITs, Landshare enables users to stake, trade, and earn passive income through its ecosystem.

What makes Landshare stand out?

- Fully tokenized rental properties

- Integrated staking platform

- Real-time asset transparency

- DeFi integration for additional yield opportunities

Landshare empowers users to move beyond REITs and into a more flexible, modern, and profitable model of real estate investing.

📈 Future Outlook: The Rise of Blockchain Property Investment

As the real estate industry embraces blockchain technology, tokenized real estate is poised to become a cornerstone of any forward-thinking investment portfolio.

With the benefits of liquidity, transparency, and accessibility, it's clear that tokenized property investment is not just an alternative to REITs—but an upgrade.

By 2025, as more investors demand control, speed, and lower costs, tokenisation will become the standard—not the exception.

🏁 Conclusion

The shift from traditional REITs to tokenized real estate marks a pivotal moment in property investment. Platforms like Landshare are making it possible to invest in U.S. real estate smarter, faster, and globally.

Whether you're a seasoned investor or just entering the Web3 space, it's time to ask:

Why settle for outdated REITs when tokenization offers so much more?

Global Investors to Access $337T Real Estate Market Through US-based Crypto Projects

Landshare Team

With Bitcoin dropping by more than 12% in the past seven days and Ethereum by 24% in the past month, investors are seeking alternatives in these unstable market conditions. To diversify their portfolios with less volatile bets, global investors are targeting the $337T real estate market.

The real estate market is known for its entry barriers due to the heavy capital investment required. However, several US-based crypto projects are changing this through real estate tokenization.

One project leading this revolution is Landshare. So, let’s see what’s driving this change and why tokenized real-world assets (RWAs) are seen as the next big thing in the investment circuit right now.

Real Estate Tokenization Industry to Reach $19.4 Billion by 2033

Traditional real estate investing has mostly been a playground for the ultra-wealthy and institutional players. A single property often requires six-figure minimums, while cross-border deals involve high legal complexity.

RWA tokens change the game. By fractionalizing property ownership, blockchain helps investors buy shares for as little as $1. This shift mirrors the stock market’s evolution from exclusive trading floors to smartphone apps. But, of course, decentralization plays a huge role here.

Moreover, regulatory clarity under frameworks and the SEC’s maturing stance on security tokens provide a stable foundation. Meanwhile, institutional giants like JPMorgan and BlackRock have begun experimenting with tokenized assets. This too brings in confidence in the model for retail investors.

How U.S. Crypto Projects Are Leading the RWA Change?

While global platforms have made healthy progress in their tokenization efforts, American crypto projects like Landshare hold distinct advantages:

Institutional Trust: U.S. legal structures attract risk-averse capital.

Tech Infrastructure: Strong DeFi platforms (e.g., Chainlink, Aave) allow for smooth asset management.

Liquidity: Selling real estate in the US can be challenging because of the legal complexity. However, trading RWA tokens is quite simple and provides almost instant liquidity to the investors.

Why Landshare Stands Out as a Top RWA Contender?

.png)

Real Utility Over Hype: Investors actively seek value-adding projects rather than hype machines. Landshare, with its tokenization utility, is a strong contender for long-term gains in this digital economy. Unlike speculative RWA projects, Landshare’s security tokens represent legal stakes in U.S. properties. Investors also earn passive income from rent.

Scarcity & Burns: With 5.34 million tokens (all circulating) and a burn mechanism on every RWA purchase, LAND is inherently deflationary in nature. In contrast, many competitors have no supply cap or burning mechanisms.

Real Properties Tokenized: Landshare has already sold 4 U.S. homes via BNB Smart Chain, with deeds tied to RWA Tokens. This shows its focus on actually profiting from real estate deals, unlike competitors relying primarily on hype for price growth.

Revenue Model: Rental income and appreciation distributed to investors; with annual returns exceeding 8.7%.

BNB Chain Advantage: Ethereum’s gas fees make micro-investments impractical. Landshare’s BNB Chain base allows for fractional ownership and targets retail demand.

Undervalued Entry: At a $3.11 Million market cap, Landshare offers higher growth chances than other overvalued RWA competitors despite similar revenue streams.

SAFU Investment: Structured under U.S. regulatory guidelines, Landshare has given special importance to compliance and security.

Moreover, LAND has delivered consistent ROI through property appreciation and rental distributions. This undervalued status highlights a perfect opportunity for investors looking for projects with high potential.

Conclusion

So, the road ahead is clear: tokenization will absorb a growing share of the $337T real estate market. For investors, these benefits offer balance and profitability:

Diversification: Allocate fractions of capital across global markets.

Liquidity: Trade property shares 24/7 on secondary markets.

Transparency: Blockchain’s immutable ledger reduces fraud risk.

For U.S. projects, the challenge lies in scaling while maintaining compliance. This gap too has been filled by Landshare. With plans to expand its property portfolio, this RWA token allows users to invest in the real estate industry at low costs and earn high long-term gains.

.png)

%20(3).png)