Landshare DAO Now Live!

Landshare Team

The Landshare team is thrilled to announce the Landshare DAO is officially live!

With the Landshare DAO, high-level decisions are put in the hands of LAND holders through a decentralized governance model. The DAO gives LAND holders the ability to exercise administrative control over staking vaults, manage the DAO treasury, create customized marketing bounties, and much more.

To read more about what the Landshare DAO is, and what LAND holders will be able to do within the DAO, click here.

Landshare Token Migration

Alongside with the launch of the Landshare DAO, a token migration is required. To begin migrating your tokens please use the link located below.

NOTE: The only official migration page is https://app.landshare.io/migration Please verify the URL and do not try to migrate your tokens through any other means!

We want to make the migration process as simple and painless as possible. Our migration page will take you through the process step by step, all the way from staking your V1 tokens to staking your V2 tokens with no interruptions. Please see the guides below for each type of migration:

If your tokens are on Gate.io, they will automatically be migrated, and no action is required on your part.

To read more about the migration process and receive some tips about how to optimize your token migration, please click here.

DAO Overview

The Landshare DAO can be viewed as an expansion of our existing Governance Protocol — more powerful, more autonomous, and now central to the operation of the platform. The Landshare DAO is designed to give LAND Token holders control over the Landshare ecosystem with the LAND Token as a means of governance. With the transition to a DAO model, token holders will take control of a token fund and have administrative control over staking vaults and other platform features.

On a basic level, the DAO works like this:

- Anyone holding at least 100 LAND can create a proposal using our prebuilt templates or by building a custom proposal from scratch.

- LAND holders vote on the proposals, with each LAND token staked or held counting as 1 vote.

- If the proposal passes, it can be executed autonomously after a short arbitration process.

For a more detailed breakdown of how the DAO works, please see our docs page here.

Default proposal options

The Landshare DAO comes with 6 default proposal templates. These templates can be accessed by visiting the DAO page and pressing the “Create” button:

Each of these proposals has a prebuilt Safesnap template and can be automatically executed after a successful vote. To read more about the default proposals, click here.

In addition to the preset proposals available on the Landshare App, anyone can create a custom proposal using Snapshot and the Safesnap plugin. Custom proposals can be created if none of the existing presets fit the criteria of your proposal.

Staking management

The Landshare DAO has direct control over the new staking vaults, with the ability to directly change vault allocations, total minting rate, and Auto LAND fees.

The Change Vault Allocation proposal allows the DAO to directly change the daily reward allocation of LAND Tokens in the staking contract. A total of 3500 LAND per day is split among three pools:

- Burn Pool: Any allocation to the burn pool prevents those tokens from being minted. Tokens should be allocated to the burn pool if there is a desire to reduce the total staking rewards. Inversely, tokens can be removed from the burn pool to increase rewards.

- LAND Staking: Tokens allocated to LAND Staking are distributed to those who stake LAND in both the Staking and Auto LAND pools.

- LP Staking: Tokens allocated to LP Staking are distributed to those who stake Pancakeswap LAND-BNB LP Tokens.

Treasury Grants

Treasury grants are specific requests for funds from the Landshare DAO Treasury. Anyone can request funds for any purpose, including but not limited to:

- Creating content including videos, Tweets, or articles

- Third party partnerships, such as LP Farms

- Developing features or updates to the platform

If you are a content creator, developer, or marketer and would like to contribute to the Landshare ecosystem, requesting a treasury grant is a great way to get started. For a full guide on submitting a grant request use our guide located here.

Marketing Bounties and Contests

The DAO can create LAND reward incentives for engagement and content creation using the Marketing Fund. This system is design to allow the community to incentive grassroots engagement and reward content creators, community members, or anyone that wants to help spread the word about the Landshare platform.

Marketing bounties and contests can be created by the DAO, pledging a certain amount of LAND tokens as a reward for a given task. Examples of tasks could include:

- Writing an educational piece of content about the Landshare platform

- Sharing prominent announcements about Landshare on Twitter

- Creating videos about the Landshare platform or features

- Any other idea that the DAO would like to propose!

These funds can be used in two ways: bounties and contests. Bounties are simple tasks such as posting on Twitter, Reddit, or Coinmarketcap. After a bounty goes live, anyone in the community can participate by posting proof of completion to the DAO admins.

Contests, on the other hand, are designed to reward a limited number of entries of the highest quality. In this case, the community votes for the winners after a designated submission period.

For a full guide on creating a bounty or contest you can use our guide located here.

DAO and Migration Resources

If you are new to Landshare or have questions about the DAO or token contract migration, please see below for a list of useful resources:

- Feature Preview: Landshare DAO

- Landshare Token Migration

- DAO Deep Dive and Token Changes

- Landshare DAO Overview (Video)

- Landshare Docs

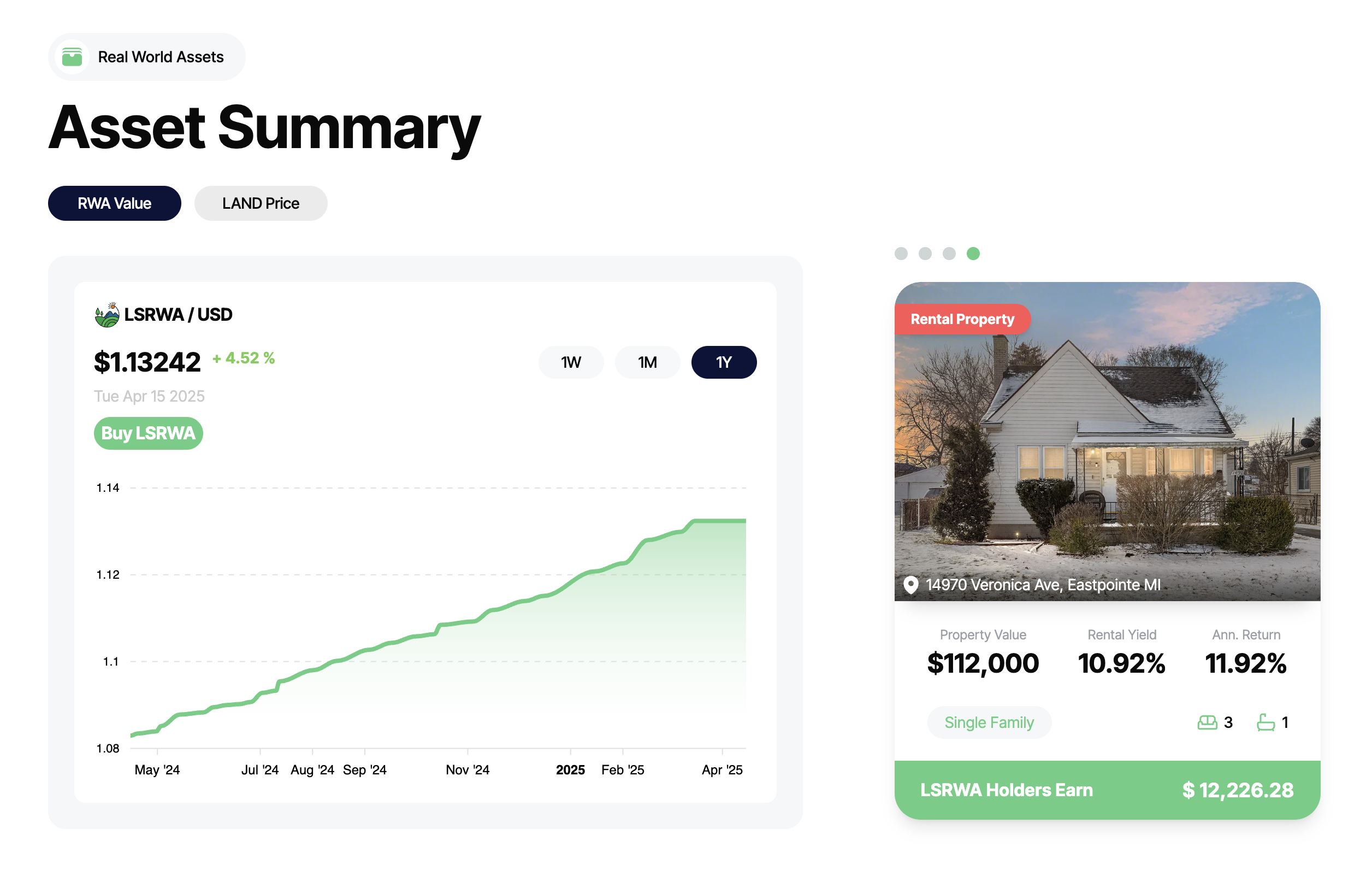

About Landshare: Invest in Tokenized Real Estate with as little as $50 directly on the blockchain through the Landshare platform. Landshare’s property offerings are carefully vetted and hand selected among thousands of potential options. View the current offerings at https://app.landshare.io/property-details

Find us on:

Beyond REITs: How Tokenized Real Estate is Changing U.S. Property Investment in 2025

Landshare Team

In 2025, the landscape of property investment in the U.S. is being reshaped—not just by shifting market trends, but by a powerful technological revolution: tokenized real estate.

While Real Estate Investment Trusts (REITs) have long served as a gateway for fractional property ownership, a new wave of blockchain property investment platforms is offering something REITs never could—global access, 24/7 liquidity, and full transparency. This is the age of tokenisation, and platforms like Landshare are leading the way.

💡 What Are REITs and Why Have They Been Popular?

REITs have traditionally allowed investors to gain exposure to real estate without directly owning physical property. They're regulated investment vehicles that pool money to purchase or manage income-producing real estate.

Benefits of REITs:

- Steady dividend income

- Exposure to property markets without physical management

- Liquidity (especially with public REITs)

However, REITs come with limitations:

- Lack of transparency

- High management fees

- Restricted market hours

- Limited global access

🔄 REIT vs Tokenisation: Why 2025 Is a Turning Point

Enter tokenized real estate—a model that leverages blockchain technology to digitally represent ownership in real-world properties through tokens. Unlike REITs, where investors buy into a fund, tokenization allows direct, transparent, and programmable ownership in individual assets.

Key Advantages Over REITs:

✅ 24/7 Liquidity – Trade property tokens any time on decentralized exchanges

✅ Fractional Ownership – Invest with as little as $1

✅ Smart Contract Automation – Dividends, ownership transfers, and reporting managed on-chain

✅ Global Participation – Anyone with an internet connection can invest in U.S. real estate

🌍 Globalizing U.S. Property Investment

One of the most significant advantages of tokenized real estate in 2025 is the global democratization of U.S. real estate markets. With regulatory frameworks maturing and platforms like Landshare providing fully-compliant solutions, international investors are able to access U.S. property markets without intermediaries.

This opens the door for:

- Global investors in emerging markets

- Digital nomads and crypto holders

- Institutions seeking stable, asset-backed returns

💼 Landshare: A Leader in Tokenized Real Estate

At the forefront of this transformation is Landshare—a blockchain platform that offers tokenized access to real, income-producing U.S. properties. Unlike traditional REITs, Landshare enables users to stake, trade, and earn passive income through its ecosystem.

What makes Landshare stand out?

- Fully tokenized rental properties

- Integrated staking platform

- Real-time asset transparency

- DeFi integration for additional yield opportunities

Landshare empowers users to move beyond REITs and into a more flexible, modern, and profitable model of real estate investing.

📈 Future Outlook: The Rise of Blockchain Property Investment

As the real estate industry embraces blockchain technology, tokenized real estate is poised to become a cornerstone of any forward-thinking investment portfolio.

With the benefits of liquidity, transparency, and accessibility, it's clear that tokenized property investment is not just an alternative to REITs—but an upgrade.

By 2025, as more investors demand control, speed, and lower costs, tokenisation will become the standard—not the exception.

🏁 Conclusion

The shift from traditional REITs to tokenized real estate marks a pivotal moment in property investment. Platforms like Landshare are making it possible to invest in U.S. real estate smarter, faster, and globally.

Whether you're a seasoned investor or just entering the Web3 space, it's time to ask:

Why settle for outdated REITs when tokenization offers so much more?

Global Investors to Access $337T Real Estate Market Through US-based Crypto Projects

Landshare Team

With Bitcoin dropping by more than 12% in the past seven days and Ethereum by 24% in the past month, investors are seeking alternatives in these unstable market conditions. To diversify their portfolios with less volatile bets, global investors are targeting the $337T real estate market.

The real estate market is known for its entry barriers due to the heavy capital investment required. However, several US-based crypto projects are changing this through real estate tokenization.

One project leading this revolution is Landshare. So, let’s see what’s driving this change and why tokenized real-world assets (RWAs) are seen as the next big thing in the investment circuit right now.

Real Estate Tokenization Industry to Reach $19.4 Billion by 2033

Traditional real estate investing has mostly been a playground for the ultra-wealthy and institutional players. A single property often requires six-figure minimums, while cross-border deals involve high legal complexity.

RWA tokens change the game. By fractionalizing property ownership, blockchain helps investors buy shares for as little as $1. This shift mirrors the stock market’s evolution from exclusive trading floors to smartphone apps. But, of course, decentralization plays a huge role here.

Moreover, regulatory clarity under frameworks and the SEC’s maturing stance on security tokens provide a stable foundation. Meanwhile, institutional giants like JPMorgan and BlackRock have begun experimenting with tokenized assets. This too brings in confidence in the model for retail investors.

How U.S. Crypto Projects Are Leading the RWA Change?

While global platforms have made healthy progress in their tokenization efforts, American crypto projects like Landshare hold distinct advantages:

Institutional Trust: U.S. legal structures attract risk-averse capital.

Tech Infrastructure: Strong DeFi platforms (e.g., Chainlink, Aave) allow for smooth asset management.

Liquidity: Selling real estate in the US can be challenging because of the legal complexity. However, trading RWA tokens is quite simple and provides almost instant liquidity to the investors.

Why Landshare Stands Out as a Top RWA Contender?

.png)

Real Utility Over Hype: Investors actively seek value-adding projects rather than hype machines. Landshare, with its tokenization utility, is a strong contender for long-term gains in this digital economy. Unlike speculative RWA projects, Landshare’s security tokens represent legal stakes in U.S. properties. Investors also earn passive income from rent.

Scarcity & Burns: With 5.34 million tokens (all circulating) and a burn mechanism on every RWA purchase, LAND is inherently deflationary in nature. In contrast, many competitors have no supply cap or burning mechanisms.

Real Properties Tokenized: Landshare has already sold 4 U.S. homes via BNB Smart Chain, with deeds tied to RWA Tokens. This shows its focus on actually profiting from real estate deals, unlike competitors relying primarily on hype for price growth.

Revenue Model: Rental income and appreciation distributed to investors; with annual returns exceeding 8.7%.

BNB Chain Advantage: Ethereum’s gas fees make micro-investments impractical. Landshare’s BNB Chain base allows for fractional ownership and targets retail demand.

Undervalued Entry: At a $3.11 Million market cap, Landshare offers higher growth chances than other overvalued RWA competitors despite similar revenue streams.

SAFU Investment: Structured under U.S. regulatory guidelines, Landshare has given special importance to compliance and security.

Moreover, LAND has delivered consistent ROI through property appreciation and rental distributions. This undervalued status highlights a perfect opportunity for investors looking for projects with high potential.

Conclusion

So, the road ahead is clear: tokenization will absorb a growing share of the $337T real estate market. For investors, these benefits offer balance and profitability:

Diversification: Allocate fractions of capital across global markets.

Liquidity: Trade property shares 24/7 on secondary markets.

Transparency: Blockchain’s immutable ledger reduces fraud risk.

For U.S. projects, the challenge lies in scaling while maintaining compliance. This gap too has been filled by Landshare. With plans to expand its property portfolio, this RWA token allows users to invest in the real estate industry at low costs and earn high long-term gains.

Landshare's Loan Protocol: Access Liquidity Without Selling Your Tokens

Landshare Team

At Landshare, we aim to make real estate investment accessible to everyone. By tokenizing real estate assets, we allow users to invest in prime properties worldwide without the massive upfront cost.

We’ve brought out our latest update: the Loan Protocol. Through this, token holders can access liquidity without selling their assets by using Landshare Tokens (LAND) or Real World Asset Tokens (LSRWA) as collateral.

This creates a mutually beneficial scenario for both borrowers and lenders. Borrowers gain the cash flow they need, while lenders earn consistent returns through interest. How does this work? Let’s discuss

The Promise of Loan Protocol

If you’re holding LAND or LSRWA tokens, why let them sit idle when you can borrow USDC and put your assets to work?

With the Landshare Loan Protocol, you don’t need to sell your valuable tokens to access liquidity. Instead, you can use them as collateral and get the funds you need while retaining ownership of your assets. Whether you want to cover personal expenses, make new investments, or take advantage of other opportunities by borrowing USDC through Landshare, you can maximize tokens' potential without parting with them.

As a lender, the protocol helps you earn 10% APY by contributing USDC.

How does it work?

The Landshare Loan Protocol has two distinct pools: one for LSRWA tokens and another for LAND tokens. Each of these pools has a set maturity date, the deadline by which loans must be repaid. If the loan isn’t repaid by this date, the collateral used by the borrower will be liquidated, meaning it will be sold to recover the loan amount.

The completion percentage displayed for each pool shows how much time has passed in the loan term. For example, if the completion percentage is 50%, half the term is completed, and the same amount of time remains before the maturity date.

Once the loan term ends and the maturity date is reached, lenders will get their USDC back along with the interest earned during the loan period. This interest comes from the borrower’s repayment and is set at 10% APY. This means borrowers pay 10% in interest, and lenders earn 10% on their funds. As a lender, your USDC is secured by the collateral the borrower has provided—either LAND or LSRWA tokens. This makes the system secure for lenders since their funds are protected.

The protocol uses over-collateralization to reduce the risk for lenders. This means that borrowers must provide more collateral than the value of the loan they’re taking.

For example, in the LSRWA pool, a borrower can only withdraw up to 50% of the value of their collateral. So if someone deposits $100 worth of LSRWA, they can only borrow 50 USDC. This extra collateral helps to protect lenders because the loan is backed by more than the borrowed amount, lowering the chances of a loss in case the borrower defaults.

If a loan is not repaid by the maturity date, the collateral (either LSRWA or LAND) will be sold to pay back the loan amount, including any interest. A 10% liquidation fee is also levied.

After the liquidation, if there is any remaining balance from the sale of the collateral, the borrower can claim it. This process ensures that lenders are compensated even if a borrower fails to repay the loan.

How to borrow USDC using LSRWA and LAND

The process of borrowing USDC by pawning your LSRWA and LAND tokens is straightforward. Let’s walk through it:

- As discussed, there are two pools for each of the tokens: LSRWA and LAND. Press the Borrow button of the pool against which you want to borrow USDC.

- Next, a pop-up will appear on your screen. Enter the amount of USDC you wish to borrow. Once you do that, the collateral amount will be displayed immediately.

- Now, simply press the Borrow button and approve the transaction in your wallet. You will be able to see the borrowed USDC in your wallet.

How to lend USDC using LSRWA and LAND

You can lend your stablecoins through this protocol and earn 10% APY. The process is simple. Let’s look at it:

- This time, press the Supply button.

- Next, a pop-up will appear on the screen. Enter the amount you can supply and hit the " Supply" button.

Enhanced Capital Efficiency with $LSRWA

We’re rolling out a new borrowing strategy that unlocks triple the earning potential for our users. You’ll be able to borrow against staked LSRWA-USDT LP Tokens, allowing you to stack rewards from three sources at once:

- LSRWA appreciation

- LSRWA-USDT LP staking rewards

- Gains from borrowed USDC

But wait, there’s more! 👀

If you buy $LSRWA via the DS Dashboard, you’ll earn NFT Credits. These credits can be used to mint NFTs and unlock even more rewards, taking your real estate investing to the next level with a touch of DeFi magic!

How the new borrowing strategy will work:

1. Create LP Tokens: Pair USDT and LSRWA on DS Swap to generate LSRWA-USDT LP Tokens.

2. Wrap and Stake: Deposit LP Tokens into a wrapped contract to keep earning LAND yields.

3. Borrow USDC: Use your wrapped LP Tokens as collateral and unlock USDC via our Loan Protocol.

💡 Why is this exciting? This strategy supercharges your capital efficiency, letting you grow your portfolio without missing out on staking rewards or token gains.

Final Note

Borrowing through the Landshare Loan Protocol offers more than just quick access to cash—it’s an opportunity to make your tokenized assets work for you. You don’t have to choose between selling your tokens and staying liquid.

With a fixed maturity date and competitive interest rates, this system allows you to borrow responsibly while keeping your tokens safe.

Take advantage of the liquidity your assets can provide through the Landshare Loan Protocol.

%20(3).png)

%20(2).png)